By Nomfanelo Maziya | 2025-01-05

The year 2024 proved challenging for small and medium enterprises (SMEs), with the sector experiencing significant financial deterioration, which led to an 83.46 per cent increase loss when compared to 2023.

The Central Bank of Eswatini (CBE) Financial Stability Review 2024 revealed a staggering E23.3 billion loss, a sharp increase from the E12.7 billion loss recorded in 2023.

While revenue saw some growth, it was eclipsed by a near doubling of operating expenses.

The construction industry within the SME sector was the most affected, being the only industry to report losses throughout the review period. The report also revealed a concerning trend of increasing reliance on debt financing among SMEs.

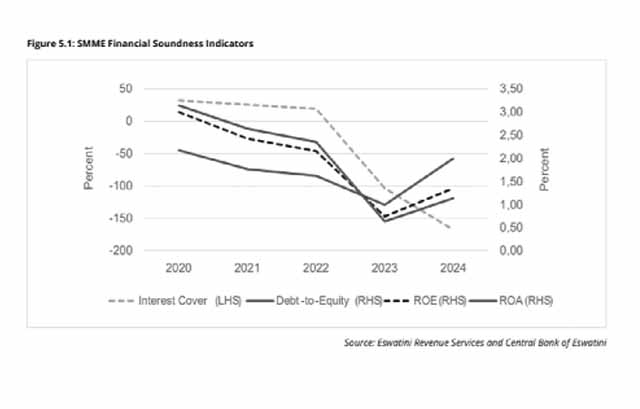

The sector's debt-to-equity ratio jumped from one per cent to two per cent, indicating a potentially unsustainable dependence on borrowed funds, according to the CBE.

This trend, if left unchecked, could further exacerbate financial vulnerabilities, especially if income generation doesn't improve.

High debt levels may also restrict SMEs' ability to invest in expansion and innovation, potentially leading to a cycle of stagnant profitability across the sector.

These further raised concerns about potential credit defaults and systemic risks as key performance indicators within the SME sector also showed a sharp decline.

The interest coverage ratio, which measures a company's ability to meet its interest obligations, plummeted from -103.6 per cent to -167.7 per cent. According to the CBE, this negative ratio indicates that SMEs are struggling to generate sufficient earnings to cover their interest expenses, significantly increasing the risk of default on loan repayments.

Furthermore, both return on equity (ROE) and return on assets (ROA) declined during the reporting period, falling from -0.2 per cent to -0.7 per cent for ROE and from -0.1 per cent to -0.2 per cent for ROA between June 2023 and June 2024.

These negative trends negatively impact the sector's creditworthiness, making it increasingly difficult for SMEs to secure financing.

The financial strain extends beyond SMEs. As of June 2024, the broader corporate sector also exhibited signs of heightened financial distress.

This was made evident by rising leverage ratios and a significant decline in profitability.

The period closed with a substantial loss of E20.4 billion, a dramatic increase compared to the E1.3 billion loss recorded in the previous year.

Furthermore, both large corporations and SMEs experienced this profitability downturn, with SMEs facing consecutive years of losses.

On the other hand, the CBE reported that large corporates faced a profitability squeeze.

The review period witnessed a sharp contraction in profitability coupled with rising debt levels, raising concerns about the sector's financial stability.

In 2024, profits for large corporations plummeted by approximately 74.1 per cent compared to the previous year, primarily driven by a 46.2 per cent decline in revenue.

This significant deterioration in profitability, according to the CBE was reflected in a notable decrease in both return on equity (ROE) and return on assets (ROA) ratios.

While total debt decreased from E37.9 billion in 2023 to E29.4 billion in 2024, the debt-to-equity ratio increased from 1.1 per cent to 1.3 per cent. This indicates a sharper decline in equity than in overall debt, raising concerns about heightened financial vulnerability.

If this trend persists, the CBE projected that continued erosion of equity could significantly amplify financial fragility and increase the risk of insolvency for large corporates.

Furthermore, the interest cover ratio, a key measure of a company's ability to meet its interest obligations, fell from 13.5 per cent in 2023 to 5.7 per cent in 2024.

share story

Post Your Comments Below

A Mabuza family of Ntamakuphila in Siteki is demanding answers from Siteki police, who are allege...

DISRUPTIVE rain that may lead to localised flooding over some parts of the country is expected fr...

FOLLOWING Ingwenyama’s gift of E33 million to the regiment after their month-long Inc...

SOCCER - HUNGRY for blood!

The power struggle at Mbabane Highlanders is worsening by each p...

All material © Swazi Observer. Material may not be published or reproduced in any form without prior written permission.

Design by Real Image Internet