By Nomfanelo Maziya | 2024-12-28

Mortgage lending in the kingdom has witnessed growth in the year ending June, reaching E4 billion from E3.8 billion in the previous year.

According to the Central Bank of Eswatini (CBE) financial stability review 2024, the growth was overshadowed by a significant rise in non-performing loans (NPLs) within the mortgage portfolio.

The NPLs ratio for mortgages climbed to 9.6 per cent in June, a substantial increase from 7.3 per cent in the previous year.

This indicates that despite relatively favourable financial conditions, a significant portion of mortgage borrowers are struggling to meet their repayment obligations, according to the CBE.

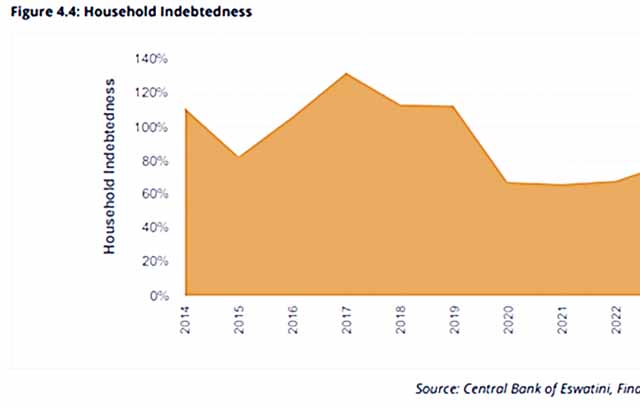

As of June, the level of household indebtedness decreased to 76.8 per cent, down from 79.0 per cent in the previous assessment.

“This improvement is largely attributed to an increase in household income, reflected in a higher disposable income to GDP ratio,” says CBE.

Specifically, the disposable income-to-GDP ratio improved to 23.8 per cent during the review period, compared to 21.6 per cent recorded in June 2023.

“Additionally, household credit as a proportion of GDP has decreased, falling from 15.9 per cent in 2023 to 15 per cent in 2024,” said the CBE.

The household debt-service ratio also saw a marginal improvement, closing at 54.8 per cent in June, compared to 55.1 per cent in the corresponding period of the previous year.

The CBE further observed a notable increase in residential real estate development on Swati Nation Land (SNL), driven by the expansion of rural loan facilities offered by banks.

While this expansion provides much-needed access to housing finance for rural communities, it also presents new challenges.

The use of pension funds as collateral for rural housing loans introduces new financial stability risks.

The CBE recommends that lenders must conduct thorough risk assessments to ensure borrowers fully understand the implications of using pension funds as collateral and that they can comfortably meet their loan obligations without compromising their long-term retirement security.

“Managing these risks requires careful regulation, adequate risk assessment by the lenders, and ensuring that borrowers are not overexposed to debt that could threaten both their short-term financial health and long-term retirement security,” said the CBE.

share story

Post Your Comments Below

SOCCER - MBABANE Highlanders' challenges might leave the club poorer in personnel as their Manage...

Faced with financial challenges, Mshengu High School Headteacher

Kenneth Simelane was among...

SOCCER - SWIMMING against the tide!

Despite a stern warning to Premier League of Eswatini (P...

THE Minister of Information, Communication and Technology (ICT) Savannah Maziya has sucessf...

All material © Swazi Observer. Material may not be published or reproduced in any form without prior written permission.

Design by Real Image Internet