By NOMFANELO MAZIYA | 2024-10-22

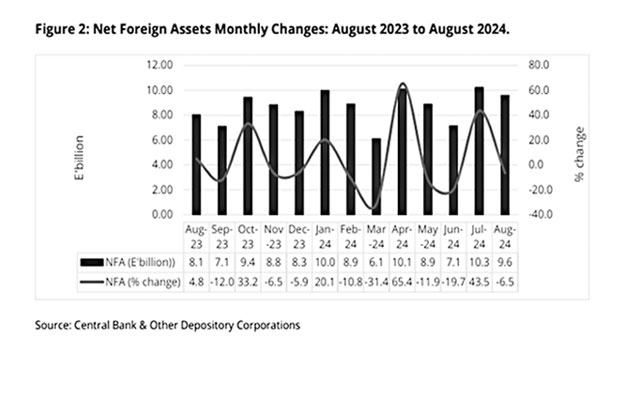

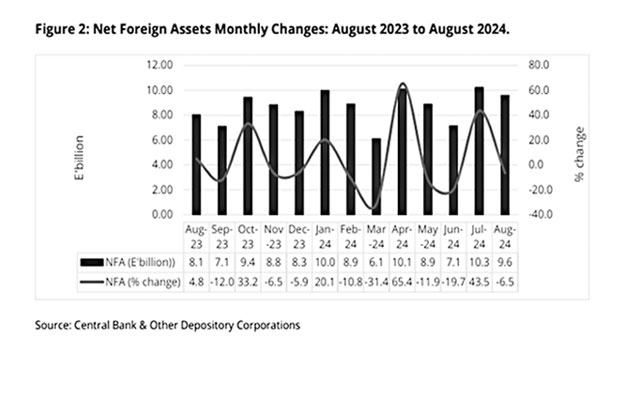

The country’s official sector experienced a 6.2 per cent decline in its net foreign assets in August, driven by net outflows from transactions with commercial banks and the financing of government's external obligations.

Overall, the country’s net foreign assets’ value increased by 15.7 per cent year-on-year, to reach E9.6 billion during the period under review.

Net foreign assets of the official sector amounted to E7.1 billion at the end of August ‘down by 6.2 per cent month-on-month and higher by 27.5 per cent year-on-year’.

This development suggested that the official sector had been utilising its foreign exchange reserves to support domestic economic activity and meet government's financial needs.

While this could be a short-term measure to address liquidity concerns or fund essential projects, it would be crucial to monitor these outflows to ensure that the country's foreign exchange reserves remain at a sustainable level.

This is contained in the central Bank of Eswatini’s (CBE) recent developments report for August and September.

The official sector and other depository corporations both saw decreases in their net foreign assets.

Other depository corporations experienced a more significant decline of 7.3 per cent month-on-month and 8.8 per cent year-on-year to reach E2.4 billion at the end of August.

This decline, according to CBE was primarily attributed to reduced investments within the Common Monetary Area (CMA).

Despite these short-term fluctuations, Eswatini's net foreign assets remain in a relatively strong position.

The year-on-year growth of 15.7 per cent indicated a positive trend, reflecting the country's efforts to strengthen its foreign exchange reserves. “Net foreign assets valued in special drawing rights (SDR), declined by 5.3 per cent month-on month and grew by 21.2 per cent year-on-year to close at SDR 401.7 million at the end of August ,” said CBE.

Preliminary data also indicated that the country’s gross official reserves amounted to E8.3 billion at the end of September.

This reflected a 17.8 per cent decline month-on-month and an increase of 9.1 per cent year-on-year.

The month-on-month decline in reserves was largely attributed to net Rand outflows from trades with local banks as well as financing of government’s external obligations over the month under review, as mentioned earlier.

“At this level, the reserves were sufficient to cover 2.2 months of imports, lower than the 2.7 months observed in August,” it says.

On another note, the banking sector's net claims on the government surged from negative E23.9 million in July to E1.4 billion in August.This significant increase was primarily driven by a rise in claims on the government, resulting from an advance from the Central Bank and higher investments in government securities.

Consequently, claims on government expanded by 23.2 per cent to E7.5 billion. However, government deposits witnessed a slight decline of 0.2 per cent to E6.1 billion at the end of August.

share story

Post Your Comments Below

Legendary gospel musician Sipho ‘Big Fish’ Makhabane will be adding the South African...

MBABANE Senior Magistrate Sifiso Vilakati has had enough – and now wants something to be do...

IT never rains, but pours for the University of Eswatini (UNESWA) as the Eswatini Water Services ...

The country’s official sector experienced a 6.2 per cent decline in its net foreign assets ...

All material © Swazi Observer. Material may not be published or reproduced in any form without prior written permission.

Design by Real Image Internet