By Bahle Gama | 2019-11-12

There is currently E140 million set aside for Micro Small medium Enterprises (MSMEs) through the Loan Guarantee Scheme.

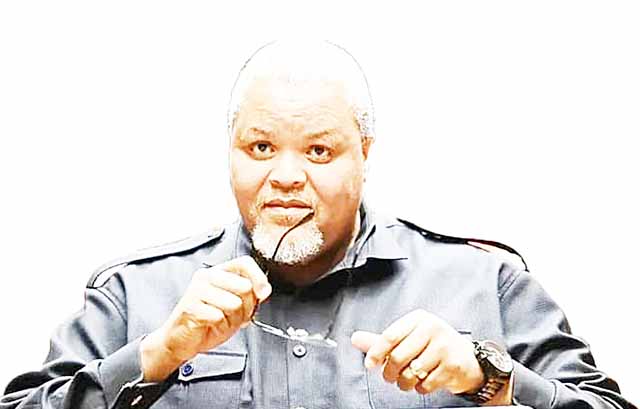

This was revealed by minister of Commerce, Industry and Trade Manqoba Khumalo during the Eswatini SME Finance Forum hosted by the ministry of finance and the Centre for Financial Inclusion (CFI) at Royal Villas yesterday.

The minister said financial institutions could be approached to look for funding in the event one submitted a business case that was bankable and had been taken through a number of institutions like SEDCO.

He added that MSMEs were not taking advantage of these funds due to issues of collateral, which is a hindrance to most.

“This is why government spoke about a credit register with intent to improve some of the collateral determinations. It is important that a SME be credit worthy because assets will be included,” he said.

He said they were trying to ensure that MSMEs thrive and one of the ways would be to ensure the uptake of the E140 million.

“The uptake presently is in the region of 10-15 per cent which means there is so much room to improve and take advantage of.

“There are so many institutions in the country that are geared towards helping MSMEs to succeed such as IDCE, the Youth Fund, SEDCO and FINCORP.

The key objective is that we want to ensure that people in business are credit worthy and can access the money. To me it is a shame that government has put out so much money yet we always complain that we do not have enough finance for SMEs,” he said.

He added that there was an export loan guarantee scheme, where a business was specifically geared towards export.

“In this scheme one can have up to E20 million available for a business, if their case is strong.

The minister said he was also happy to note that SMEs contribute to the country’s total GDP about E66 billion.

“The contribution by SMEs to the GDP is in the region of 40-45 per cent. This is impressive because it means that SMES are playing a very important and vital role in the growth of the economy,” he said. He said such a forum was one of the key activities in which the CFI, government and Central Bank of Eswatini partnered to ensure MSMEs succeed.

Khumalo further disclosed that in terms of the FinScope MSME Eswatini 2017 National Survey, Eswatini has 59 289 MSMEs. The survey further established that out of this number, only 10 per cent of the MSMEs have borrowed money from formal financial institutions.

“We would like to see this number grow rapidly. Meanwhile, the International Finance Corporation (IFC) revealed that on average, 30 per cent of MSMEs in all developing countries are fully constrained while 14 per cent are partially constrained. Sub-Saharan Africa has the largest proportion of financially constrained MSMEs, both fully and partially at 54 per cent,” he said.

share story

Post Your Comments Below

A successful two-and-a-half-year collaboration between the European Union (EU) and Germany has si...

POOL - ESWATINI’S select pool team, The Guptas, is set to compete in the prestigious Billia...

IN a fiery response on Facebook, Bishop Mpendulo Nkambule has addressed recent allegations and pr...

SOCCER - IT'S not funny anymore!

This was blurted out by senators as they reflected on the c...

All material © Swazi Observer. Material may not be published or reproduced in any form without prior written permission.

Design by Real Image Internet