By Nokunceda Magagula | 2025-03-18

A staggering 68 per cent of Emaswati are currently struggling to manage their finances, according to alarming statistics presented by the ministry of finance.

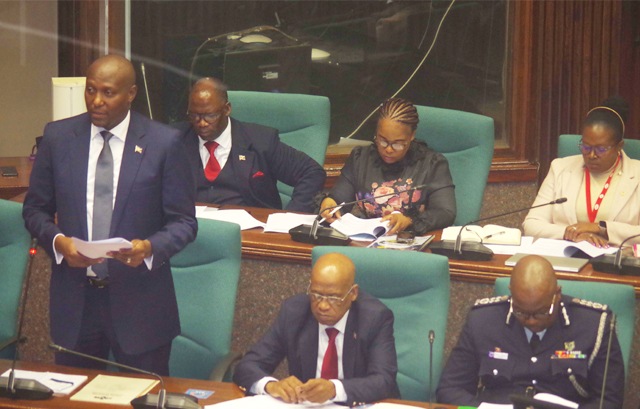

During the launch of Global Money Week 2025 hosted by the Central Bank of Eswatini (CBE), Minister of Finance Neal Rijkenberg, who was represented by Principal Secretary (PS) Vusi Dlamini, said only 26 per cent of Emaswati possess a high overall financial capability, while 62 per cent do not plan their finances effectively.

Furthermore, 61 per cent lack the knowledge necessary to manage their finances properly.

The minister emphasised the critical need for financial education, particularly among the youth, who often lack the foundational knowledge required to make informed financial decisions.

This gap in understanding leads to poor financial choices, increased debt, and a pervasive sense of financial insecurity.

"It is our duty as different stakeholders to turn this narrative around," he stated.

Rijkenberg said the connection between financial literacy and financial inclusion was profound.

Individuals equipped with sound financial knowledge were more likely to access essential financial services, such as bank accounts, loans, and insurance products. The minister said this capability not only helped them manage their finances better but also contributed to the overall economic resilience.

He pointed out that enhancing financial literacy could unlock pathways to financial inclusion, especially for marginalised communities.

"This is where the world of finance becomes accessible to all, regardless of socioeconomic status. It is not just a matter of equality; it is a question of justice and empowerment," he asserted.

The minister said as leaders and policymakers, they had a collective responsibility to create an environment where financial education was readily available. This included integrating financial literacy into the school curricula, launching community education programs, and forming partnerships with financial institutions to provide relevant resources.

"We have a collective obligation to advocate for policies that support the dissemination of financial knowledge," Rijkenberg urged.

‘‘By dismantling barriers that prevent individuals from participating in the financial ecosystem, we can ensure that every citizen, especially the youth, is equipped with the tools they need to thrive,’’ he added.

As Global Money Week unfolds, the minister called on all stakeholders to reflect on how to continue promoting financial education within their communities.

"Let us forge ahead with renewed energy to promote financial education," he said, emphasising the importance of sustained efforts beyond this week.

Rijkenberg stated that the country reflected on the core objectives of Global Money Week focusing on the theme ‘Think before you follow, wise money tomorrow’ which implied that good money management practices, such as budgeting, saving, and investing wisely, were essential to achieving financial well-being in the future.

He said theme highlighted the importance of financial literacy in achieving a sustainable future for both individuals and the nation as a whole.

“Understanding how money works is vital; it shapes our ability to make informed decisions about budgeting, saving, and investing. Financial literacy is not just about understanding numbers and concepts; it is about having the power to influence our financial futures, break cycles of poverty, and pave the way for a prosperous life,” the minister said.

share story

Post Your Comments Below

An ATM bombing case in Mbabane has been thrown into further disarray as a third lawyer has withdr...

A staggering 68 per cent of Emaswati are currently struggling to manage their finances, according...

When speaking at the 2025 Post-Budget Seminar last week, Lobamba Lomdzala MP Marwick Khum...

PRIME Minister Russell Mmiso Dlamini has maintained his stand on the existence of a cabal that is...

All material © Swazi Observer. Material may not be published or reproduced in any form without prior written permission.

Design by Real Image Internet