By SIBUSISO DLAMINI | 2024-11-24

Eswatini Revenue Service (ERS) Commissioner General Brightwell Nkambule is confident that the new TaxEase system will drive ERS to achieve its E14.5 billion revenue target this financial year, despite challenges expressed by some taxpayers and other stakeholders about the system.

Nkambule says he views the Oracle-developed platform and the ERS’ digitisation journey as a crucial leap forward, enhancing tax collection and modernising the administration.

Now midway through his third financial year at the helm since taking over from Dumsani Masilela, Nkambule reflects on the system’s impact, having narrowly missed its revenue target in his first year, but surpassed it in the second.

“We are collecting at unprecedented levels. Towards the end of some months, we see collections of up to E400 million a week. Our staff, supported by the digitisation programme, including the TaxEase system, is delivering results,” he said, expressing confidence that ERS will meet its revenue target despite ongoing challenges.

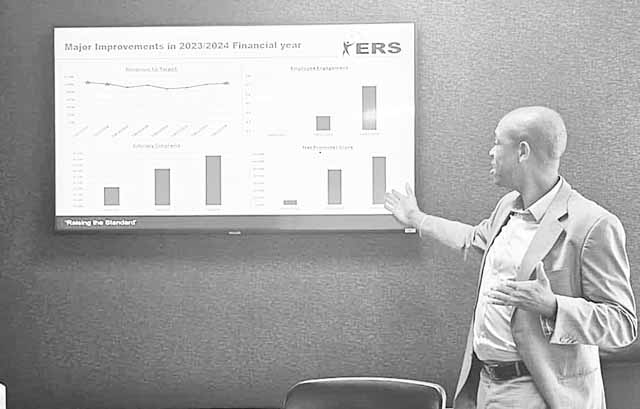

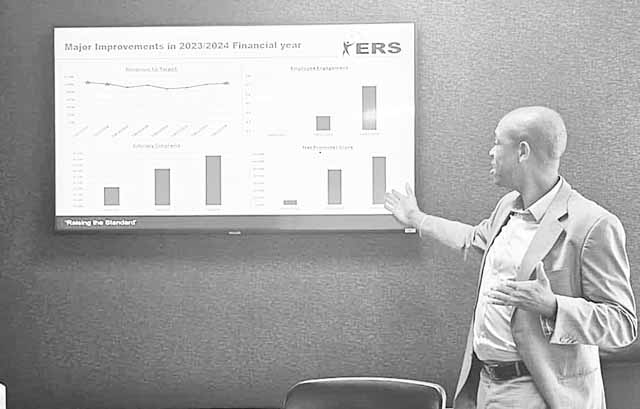

Known for his methodical approach, Nkambule presented a detailed PowerPoint during the interview to illustrate his points.

The slides, filled with data, charts, and comparative analysis, highlighted ERS’ performance metrics and the strategic alignment of the new system with the tax collector’s broader objectives.

However, one of the challenges they have been dealing with is transitioning the TaxEase system, which replaced the 12-year-old Revenue Management System (RMS), which he attributed to the natural discomfort people felt when adjusting to change.

“Discomfort from users of systems is understandable as we adapt to new systems or habits,” Nkambule said.

While admitting that users have experienced delays and glitches in accessing services, he highlighted that technical issues were part and parcel of deploying any system, particularly one as complex as TaxEase.

Originally scheduled to launch in December 2023, the migration phase face delays, ultimately going live in March.

“Systems are built and tested by humans, and while thorough testing covers most scenarios, unforeseen issues will always emerge post-implementation. This is normal in system development,” Nkambule argued.

“Bugs exist in the early days of systems. What matters is having the capacity to resolve them swiftly,” he added, revealing that ERS has secured a three-year support contract with the system Vendor to address any arising issues.

Nkambule emphasised that the shift to TaxEase represents much-needed progress for modernising the country’s tax administration, comparing the transition to upgrading from an old car to a modern vehicle with self-driving capabilities.

functional

“The RMS, which we procured in 2011, was functional, but limited by the standards of today. Technology evolves quickly, and we needed a system that could meet the demands of modern tax administration,” he explained.

He said the new Oracle based system, developed by a consortium of Canadian and U.S. firms, was chosen for its configurability and capacity for continuous improvement.

“It’s designed to offer a seamless experience for users while improving ERS’s ability to manage and collect revenue effectively,” he said, pointing out that while the previous system served its purpose, it lacked the flexibility and scalability required to support ERS’s growing needs.

Nkambule, however, defends the system’s E127 million price tag, referring to this as a necessary investment.

“This system is helping us collect an average of E1.2 billion a month, and in peak months like December, we project collections to approach E1.6 billion. When you consider the revenue it generates, the cost is justified,” Nkambule argued.

He explained that the project underwent an open tendering process, approved by the government tender board, ensuring full transparency.

Nkambule highlighted that the system’s benefits extend beyond revenue collection, including increased adaptability and the opportunity to build internal capacity.

Asked why ERS did not develop the system locally, the CG explained that creating and maintaining a system of a such scale requires substantial resources, therefore, attempting to build it internally could slow down innovation, given the ERS’ limited ICT research and development capacity.

“Over the next three years, we will build our capacity to configure the system, while Oracle focuses on research and development. This dual approach ensures we benefit from global advancements while tailoring the system to our needs,” he clarified.

“ERS resources may not be deep enough to develop such systems entirely in-house, but we can build capacity over time. This is an opportunity for our youth to step into the technology space and contribute to such projects in the future,” he added.

Nkambule pointed out several key improvements of the new system, focusing on how it enhances compliance and reduces fraudulent activities across Value Added Tax (VAT), Pay-As-You-Earn (PAYE), and income tax, while simplifying processes for taxpayers and employers.

submitted

He explained that under the old VAT system, taxpayers submitted a simplified one-page summary of VAT input (paid) and VAT output (collected), which allowed room for manipulation.

“Some individuals would overstate VAT input or understate VAT output to reduce their tax liabilities,” Nkambule said, noting that the new system requires taxpayers to submit detailed schedules for all VAT transactions.

“This ensures that claims are cross-verified, matching input VAT declarations with the corresponding output VAT reported by other entities. It leaves no room for fabricated declarations,” Nkambule said, pointing to recent data that reflects significant improvements in compliance and revenue collection.

Turning to PAYE, Nkambule discussed how the system reforms have streamlined reporting for employers while enhancing accuracy.

Previously, employers submitted a single-page summary of total PAYE contributions, including the number of employees, which resulted in a lengthy reconciliation process at the end of the financial year.

“The year-end reconciliations were often laborious, sometimes taking up to three months,” Nkambule explained, noting that the new system now requires employers to submit detailed monthly PAYE records, broken down by individual employees.

“This has reduced the administrative burden for employers while providing the ERS with more accurate and timely data,” Nkambule said, adding that the new system allows for more efficient tracking of PAYE contributions.

Nkambule also discussed the transformation in income tax reporting, explaining that taxpayers previously declared annual profits or losses and claimed expenses under broad categories, often without supporting documentation.

The new system, he said, now requires taxpayers to submit detailed records for all claimed expenses. The new system requires taxpayers to upload supporting documents, Nkambule stated, emphasising that this requirement fosters greater accountability and ensures more accurate taxable income figures.

“This ensures that tax liabilities reflect accurate figures, improving both compliance and revenue collection,” he said, also pointing out that accountants managing multiple clients now benefit from a streamlined process.

“They can access all client accounts through a single login, making their work much easier,” Nkambule added.

share story

Post Your Comments Below

As the nation eagerly anticipates the upcoming 2025/26 national budget scheduled for delivery in ...

THIS year, Eswatini’s Global Entrepreneurship Week (GEW) is shining a light on its dynamic ...

Eswatini Revenue Service (ERS) Commissioner General Brightwell Nkambule is confident that the new...

Illovo FC …........................... (1)1

Mbabane Highlanders …… (0)1...

All material © Swazi Observer. Material may not be published or reproduced in any form without prior written permission.

Design by Real Image Internet