By Qondile Ntiwane | 2019-06-19

The Swaziland Competition Commission (SCC) has implored the Central Bank of Eswatini (CBE) to ensure that banks do not charge steep fees that are not related to the cost of providing the services.

The recommendation follows an inquiry by the SCC which revealed that local bank charges are relatively high when compared with other Common Monetary Area (CMA) member countries. A report released by the Commission cited specifically Namibia and Lesotho, where the non-interest income was approximately 10 and seven per cent, respectively.

These findings are in line with the findings of the recent Limited-Scope Comparative study on basic banking fees and service which was conducted by the Central Bank of Eswatini.

The Commission noted it’s concerned that despite the introduction of the Central Bank of Eswatini Legal Notice No. 62 of 2016; bank charges were still high when compared to the other CMA member states such as Lesotho, Namibia and South Africa.

The Commission also expressed concern about the high charges because there was no justification for such to happen in the country and considering that salaries and the cost of living locally are lower than in South Africa.

The purpose of the banking market inquiry was to analyse the state of competition in the banking industry following public concerns through the media about the impact of prices of banking services on their welfare. For example, consumers described bank charges as exorbitant and unfair in that they reduce balances even in inactive accounts.

The banks were alleged to be also charging customers when reactivating dormant accounts.

“Also, the CBE registered its concerns on bank charges that remained on the higher side compared to other Common Monetary Area (CMA) member states.

“The market inquiry followed the Structure Conduct Performance (SCP) paradigm which shows that each of the three parameters have some effects on each other. The inquiry was executed on the basis of Section 11 (2) (f) of the Competition Act of 2007,” he said.

The objectives of the inquiry were to identify the relationship (if any) between the structure of the market, the conduct of the incumbent firms and their performance and also the competition concerns based on the direct and indirect effects of the market structure, performance and the conduct of banks.

share story

Post Your Comments Below

Minister of Information, Communication and Technology (ICT) Savannah Maziya says there is a criti...

On Saturday One Billion Rising Eswatini held a mountain circle hike in partnership with the Proje...

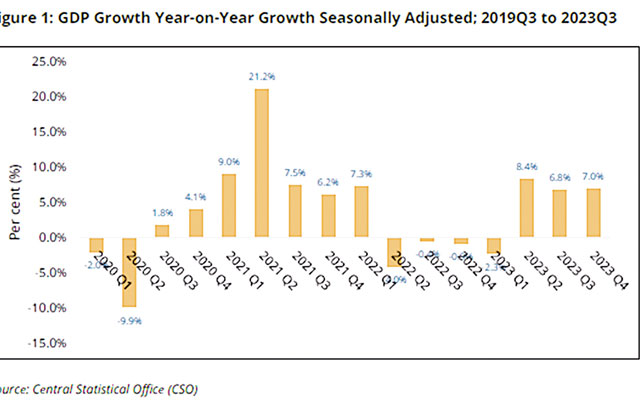

Eswatini's economic activity, measured by Gross Domestic Product (GDP), grew at a steady pace of ...

There is tension mounting between members of Parliament and their constituency headmen, who are n...

All material © Swazi Observer. Material may not be published or reproduced in any form without prior written permission.

Design by Real Image Internet