By NOMFANELO MAZIYA | 2024-04-29

The Lilangeni's recent appreciation against major foreign currencies has reduced the value of Eswatini's external debt denominated in those currencies.

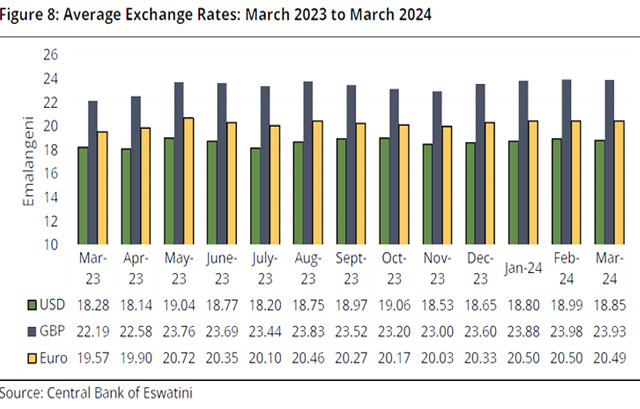

The Lilangeni's recent appreciation against major foreign currencies; 0.8 per cent against the US dollar, 0.2 per cent against the Pound Sterling and by 0.02 per cent against the Euro closed the month of March trading at E18.85 per cent, E23.93 and E29.49, respectively.

This is detailed in the recently published Central Bank of Eswatini (CBE) economic developments report for the months February and March.

It states that at the end of March 2024, Eswatini's total public debt stood at E34.4 billion, representing 37.1 per cent of GDP.

The figure marks a decline of 0.3 per cent compared to when it stood at E34.5 billion in February 2024.

While this decrease might seem insignificant, however it holds positive implications.

The primary driver of this decline is attributed to favourable exchange rate movements highlighting the country’s vulnerability of debt levels to currency fluctuations.

Debt

Breaking down the total debt further reveals contrasting trends in external and domestic debt.

Public external debt saw a favourable decrease of 4.3 per cent in March compared to February, reaching E15.6 billion.

Once again, the strengthening Lilangeni is the key factor behind this positive development, according to the report.

Public domestic debt, on the other hand, rose by 3.3 per cent in March, reaching E18.8 billion and representing 20.2 per cent of GDP.

The rise can be largely attributed to two key events.

The Central Bank extended an additional E422 million advance to government in March.

These advances are a form of domestic borrowing and contribute to the overall debt burden.

Bonds

Government also issued Plain Vanilla Bonds in March.

While bonds can be a valuable tool for financing government activities, they also add to the domestic debt stock.

The data includes a glimpse into a bond auction conducted in March 2024.

The auction offered a total of E150 million divided equally across five, seven and 10-year tenures.

The report states that bids received were valued at E167 million, surpassing the amount offered and further resulting in a bid-cover ratio and allotment ratio exceeding 100 per cent.

According to economists, this suggests strong investor appetite for Eswatini's government bonds, potentially reflecting confidence in the country's economic future.

“While the decline in total debt and external debt is encouraging the rise in domestic debt requires close monitoring,” they say.

Economists further highlight government's reliance on central bank advances and bond issuance to finance its activities.

“In that regard, there is a need for a focus on fiscal consolidation. Implementing measures to control spending and increase revenue generation will be crucial for maintaining a sustainable debt level in the long run,” say the economists.

Housing, personal loans on the rise

Eswatini's credit market is experiencing a rise in housing and personal loans, outpacing growth in motor vehicle loans.

According to Central Bank of Eswatini recent economic developments for February/March 2024, credit extended to households and non-profit institutions (NPISH) reached E8.5 billion, reflecting a year-on-year increase of 5.5 per cent.Housing loans and other unsecured personal loans witnessed the most significant growth.

Housing loans rose by 0.9 per cent to E4.3 billion, while personal loans increased by 0.7 per cent to E3.2 billion.

In contrast, the report states that motor vehicle loan growth has decelerated.

Decrease

These loans actually decreased slightly by 0.03 per cent to E1.1 billion at the end of February 2024.

The reasons behind this credit shift are not explicitly stated in the excerpt, but according to an economist, there is not much of a change in consumer spending habits.

“At less than one per cent, increases are as good as flat,” he said, noting that otherwise the loans to households for housing was linked to demand for credit for housing.

“It may suggest construction of new buildings or alterations of existing structures,” he said.

Imports decline turning deficit to surplus

Eswatini's trade sector experienced a significant rise in exports and a decrease in imports just as significant in March 2024, resulting in a trade surplus of E391.8 million from the deficit recorded in the February.

According to Central Bank of Eswatini, the star performer, soft drink concentrate exports, increased by 2.7 per cent month-on-month and 23.3 per cent year-on-year, reaching E1.715 billion.

Exports

Wood and wood article exports also witnessed a positive trend, rising by 2.5 per cent compared to February, reaching E208.1 million.

While sugar exports experienced a significant 40.9 per cent increase month-on-month, they decreased by 24 per cent year-on-year, totalling E946.3 million.

The textile and apparel industry faced a setback, with exports declining by 15.4 per cent month-on-month and 18.8 per cent year-on-year, reaching E272.7 million.

Overall, exports rose by 2 per cent year-on-year in March, reaching E3.570 billion.

This, combined with a significant 15.9 per cent decrease in imports compared to the previous month (E3.179 billion), led to a positive trade surplus.

The seasonally adjusted trade balance also painted a positive picture, with exports exceeding imports.

Looking at the first quarter of 2024, Eswatini's overall export performance remains positive. Cumulative exports reached E10.179 billion, exceeding the E8.868 billion recorded in the same period of 2023. However, the report highlights the first quarter trade surplus of E764.0 million, stating that while positive, is narrower compared to the E1.030 billion surplus achieved in the first quarter of 2023.

share story

Post Your Comments Below

SOUTH African sensation Ami Faku is billed to perform at the highly- anticipated MoMo Xperience F...

Senate President Lindiwe Dlamini claims the introduction of the pre-exposure prophylaxis and post...

SOCCER - THE strategists have spoken!

THE 2023/24 MTN Premier League campaign has r...

Applications to The Eswatini International Trade Fair are now opened.

The ...

All material © Swazi Observer. Material may not be published or reproduced in any form without prior written permission.

Design by Real Image Internet