By Nomfanelo Maziya | 2024-04-02

Nedbank Eswatini has demonstrated resilience in a complex economic environment, reporting a 10 per cent increase in headline earnings totalling E178 million for the year ended December 31, 2023.

Headline earnings per share (HEPS) was reported at 722 cents.

This achievement is testament to the bank's commitment to its purpose and collective efforts of its revenue engine across retail, wholesale banking, and treasury.

They also reported a growing appetite for asset-based finance, personal loans, and commercial property investments.

Nedbank Managing Director, Fikile Nkosi, said the challenging economic landscape was marked by lingering effects of the COVID-19 pandemic, global inflation, and rising interest rates. She said however, Nedbank Eswatini capitalised on strategic opportunities.

Slower

She said the recovery from the pandemic had been slower than anticipated therefore affecting performance.

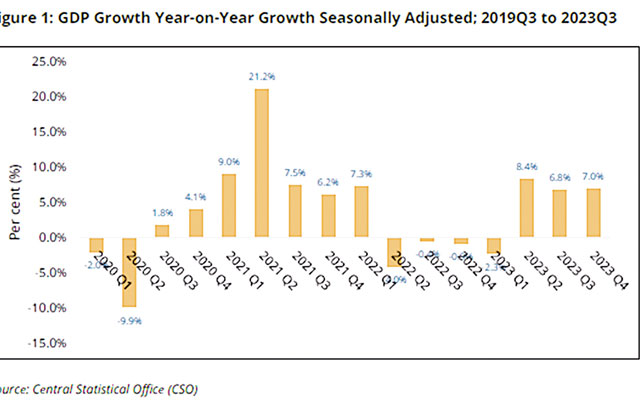

“The Eswatini economy grew modestly in 2023, with remnants of COVID-19 recovery as well as a substantial increase in the country’s SACU receipts. Global and local inflation remained at escalated levels due to the Russia-Ukraine conflict,” said Nkosi.

She said the rise in interest rates, driven by the Central Bank's contractionary monetary policy stance, fuelled a 35 per cent growth in net interest income (NII).

This increase could be attributed to the Central Bank of Eswatini's interest rate hikes throughout 2023, coupled with a slight increase in interest-earning assets.

Additionally, lower-than-expected deposit charges strengthened NII, according to the managing director.

“Our net interest income grew 26 per cent, driven by the interest rate increases, as well as marginal growth in our interest earning assets, while the charge for deposits was lower than expected due to muted growth in that line,” she said.

The bank’s impairment charge of E47 million increased by 48 per cent year-on-year, attributing the increase to a decline in clients’ ability to service debt. ‘given the higher interest rates and having access to less disposable income, the segments impacted were SME and wholesale banking.

This resulted in a credit loss ratio (CLR) of 1.2 per cent,” she said.

Nkosi further underscored that Nedbank Eswatini remained committed to its digital transformation journey.

“The bank's digital active base grew significantly, reaching 64 per cent, with a 25 per cent increase in send money volumes,” she said.

“We have seen a growth of 11 000 in our Mobi Money platform and an 11 per cent increase in our send money platform,” she said.

Nkosi stated that the bank also observed that its clients had become tech-savvy, increasing the Nedbank App’s active users by 27 per cent.

“This is very impressive especially given that it was only launched a year ago,” said Nkosi.

The Treasury department spearheaded the introduction of innovative financial solutions, including USD CFC interest-earning accounts, floating-term deposits, and negotiable certificates of deposit.

The MD noted that return on equity (ROE) inclined to 17 per cent, a 100 basis point improvement.

She further cited that the bank maintained a healthy capital adequacy ratio (CAR) of 18.4 per cent.

She said while overall expenses grew by eight per cent, slightly exceeding the inflation rate, the bank achieved an improved cost-to-income ratio of 52 per cent, reflecting strategic investments in technology aimed at unlocking future value.

“Nedbank prioritises social responsibility. as a purpose driven organisation, E1.2 million was disbursed in social investment initiatives throughout the year,” said Nkosi.

Identified

The bank also identified promising growth sectors within the economy, witnessing an increased appetite for asset based finance, personal loans, and commercial property financing.

While Nedbank Eswatini delivered a strong financial performance, there were areas for optimisation,” said Nkosi.

“Additionally, expenses grew slightly above inflation, prompting further efficiency initiatives,” she said.

Nkosi said Nedbank Eswatini remained committed to supporting government's development goals and continues to expand its digital offerings to enhance customer experiences.

share story

Post Your Comments Below

On Saturday One Billion Rising Eswatini held a mountain circle hike in partnership with the Proje...

Eswatini's economic activity, measured by Gross Domestic Product (GDP), grew at a steady pace of ...

Minister of Information, Communication and Technology (ICT) Savannah Maziya says there is a criti...

There is tension mounting between members of Parliament and their constituency headmen, who are n...

All material © Swazi Observer. Material may not be published or reproduced in any form without prior written permission.

Design by Real Image Internet